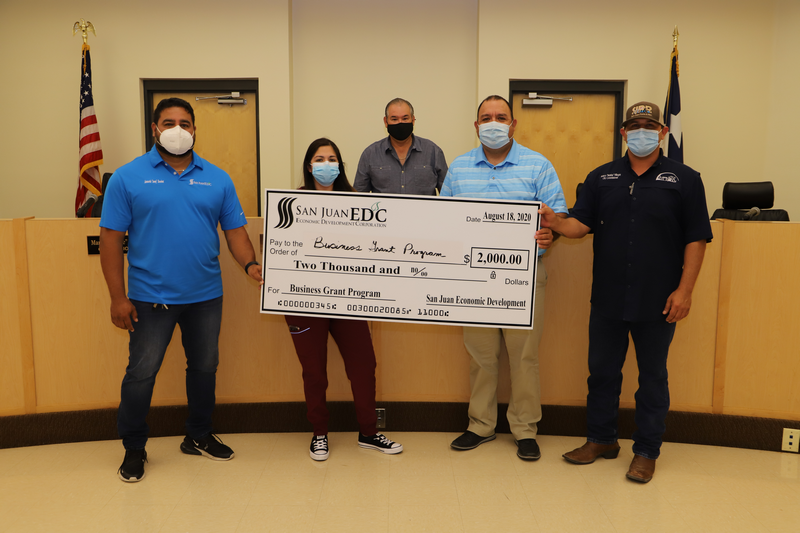

Promotional Expense Mini-Grant

San Juan EDC provides a Grant to all local businesses with a storefront within the city of San Juan which can be used towards advertising and publicity expenses.

The San Juan EDC Mini Business Grant was created to assist small businesses with financial support for a new venture or retention and expansion of existing businesses. Applicants will need to meet the requirements of the Mini-Grant Packet and submit supporting documents. The mini-grant is money that does not have to be repaid, however, the money must be used within the business and for business purposes only.

Mini-Grant requirements for the small business are as follows:

- Must have an operating storefront

- Must be operating a minimum of 40 hours per week (City or EDC can make random checks for compliance)

- Must have at least 1 full-time employee

- Must be in good standing with any revolving city loan (if applicable)

- Can only be awarded one time per business owner

- Business owner applicants are required to:

- Attend 1 free training session on business development, provided by the Small Business Development Center (SBDC)

- Prepare an executive summary with two-year projections

(Training, executive summary development, and business technical assistance can be obtained at the SBDC.)

All applicant requests are subject to board approval.

Type – A & Type – B

Economic Development Sales Tax

Permissible Type-A Projects

- Manufacturing and industrial facilities

- Research and development facilities

- Recycling facilities

- Distribution centers

- Small warehouse facilities and distribution centers

- Military facilities

- Port facilities

- Operation of commuter, light rail, and commuter buses

Type – A & Type – B

Economic Development Sales Tax

Permissible Type-A Projects (cont.)

- Primary job training facilities

- Corporate headquarter facilities

- Job training classes

- Career centers

- Telephone call centers

- General aviation business service airports

- Business infrastructure improvements

Type – A & Type – B

Economic Development Sales Tax

Permissible Type – B Projects

- All Type – A projects; and

- Retail business incentives (if the city population is less than 20,000)

- Sports and athletic facilities

- Entertainment, tourism, and convention facilities

- Public parks and related open space improvements

- Affordable housing

- Water supply and conservation programs (with special voter approval)

Type – A & Type – B

Economic Development Sales Tax

Allowable Project Expenditures

- Land and facilities improvements

- Machinery and supplies

- Financial transaction costs

- Planning costs

- Cleanup costs (requires voter approval)

- Administrative expenses

- Promotional expenses (10% annual max plus carry-over)

- Bonded debt expenses